Canadians purchase US property for a variety of reasons. Many Canadians regularly vacation in the US sunbelt or enjoy wintering in a warmer climate each year. Others may want to retire south of the Canadian border and then plan to pass their property on to their children and grandchildren. Still others choose to invest in […]

Category Archives: Blog

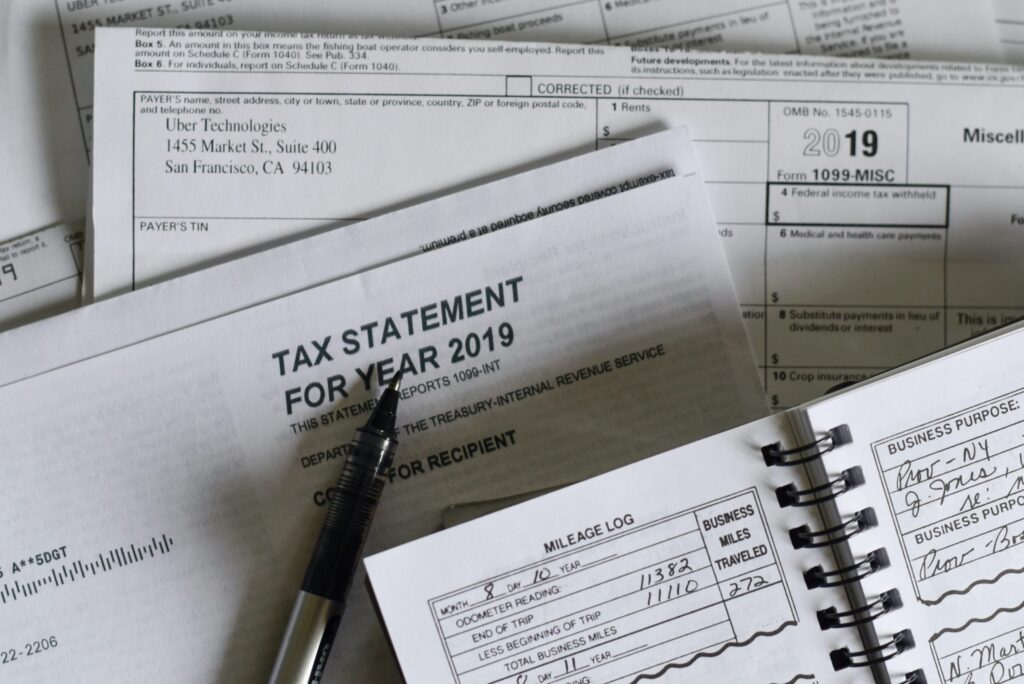

There are more than one million US citizens living in Canada. These individuals remain subject to tax by the IRS on their worldwide income and have annual filing obligations with significant penalties for non-compliance. As Canadian residents, they are also subject to Canadian taxation on worldwide income. This potential for double taxation is largely resolved […]

After spending significant time vacationing in the US, Canadian citizens who enjoy a cross border lifestyle may choose to move to the US permanently. Eventually, they may even become US citizens. There are also more than one million US citizens who are already residents and citizens of Canada. Dual citizens of the US and Canada […]

Tax Partners accountants have developed expertise to assist clients who face double taxation under the US and Canadian tax systems. Double taxation is a key issue for Canadians with US assets who spend a significant amount of time in the US each year. When Canadian owners of US real estate sell their US assets, they […]